Cum-Ex Trading – Update and Frequently Asked Questions – Series 2

In the last Series, we covered some of the basics of Cum-Ex trading – how the trade works, what factors can create a duplication of withholding tax reclaims and what a short seller is.

In the next few series we will be going over products alternative to shares that could be used in Cum-Ex. In Series 2 we look at ETFs.

What are ETFs?

In short, ETFs are a type of exchange traded investment fund which can hold a variety of assets (stocks, bonds, currencies, commodities) and typically tracks an index. However, bespoke ETFs on smaller baskets can be created. Distributing ETFs distribute dividends as and when they are received. Accumulating ETFs reinvest dividends (or coupons), generally there’s an accumulation date for tax purposes at which point the dividend received throughout the year is attributed to the investor as income.

What is an Authorised Participant?

An Authorised Participant is usually a market maker or someone active in the ETF underlying, someone who is able to create and redeem ETFs.

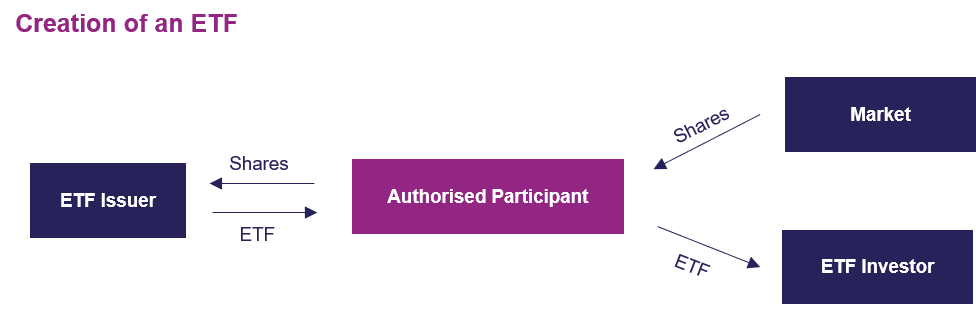

How are ETFs created and redeemed?

To explain in simplified terms - to create an ETF an Authorised Participant will:

Agree to sell the ETF to an ETF Investor

Purchase shares in the market

Deliver the shares to the ETF issuer against a creation of ETFs

Deliver the created ETF to the ETF investor

Diagram 1a

To redeem an ETF, an Authorised Participant will do the reverse. They will:

Buy the ETF from the ETF investor

Deliver the ETF to the ETF Issuer in exchange for shares

Sell the shares into the market

Diagram 1b

Both to create and redeem an ETF, there is typically two dates involved – a trade date and a settlement date. This is important to note for Cum-Ex purposes.

How can ETFs be used in a Cum-Ex context?

Similar to the Cum-Ex trades using shares, a Short Seller is involved. We explained the role of the Short Seller in Series 1.

The ETF is agreed to be created before the Ex-Dividend date when shares are trading with dividend.

Diagram 2a

By the time the ETF creation actually occurs, the shares are delivered Ex-Dividend and a manufactured dividend payment is made by the Short Seller. This manufactured dividend payment is passed through to the ETF investor who may be entitled to make WHT reclaim.

Diagram 2b

The Shareholder who received the real dividend (see Diagram 2a) and paid withholding tax may be entitled to make WHT reclaim.

The involvement of a Short Seller in the ETF issuance has created a situation where more withholding tax is reclaimed than has been paid. In Series 3, we will look at additional products that could be used in Cum-Ex.

FMCR is an industry-recognised equity dividend arbitrage expert and is currently undertaking multi-faceted investigations into high profile potentially irregular activities in several European markets.